by Joe Ament

The Green New Deal is perhaps the most audacious plan to ever seriously address the grave social and environmental challenges we face. By identifying “systemic injustice,” the plan is sweeping in its scope. Yet, while the plan discusses public banks in a reference to adequate capital, the plan fails to see the commercial banking sector as one of the structural causes of, and impediments to solving, the problems we face. Importantly, the Green New Deal fails to articulate exactly why a nationalized banking system is critical to the success of the programs its proposes.

Money is created in modern economies when commercial banks extend interest-bearing loans to individuals and corporations. The money in those loans does not exist before the loan is generated but is created when the bank marks up the borrower’s checking account. This is in stark contrast to the general notion that money is a finite resource, such as gold, that is allocated to its best economic use by the Central Bank.

When money is created by the private sector in the manner discussed above, it is seen as a private resource. Accordingly, public use of money for government spending is viewed as wasteful expenditure rather than productive investment. In the case of the Green New Deal, the massive price tag is seen as cannibalizing the productive private sector. It is for this reason that opponents of the Green New Deal argue that it will hurt the economy, and its proponents argue to “finance” the plan by moving money from one sector to another, e.g. from Wall Street to Main Street.

Money is a social relation. It is an abstract measure of what we all owe to one another.

Money, however, is not a private resource. And it is not a finite commodity. Money is a social relation. It is an abstract measure of what we all owe to one another. Think of it as a tally of everything you owe and are owed, for all the work you do and all the purchases you make. Now extrapolate that to the whole country, let the government manage it—just like it does with laws and other contracts—and you’ve got a monetary system!

The role of the government is crucial in managing the money system. Since money is a social relation, the government is responsible for the money system. Think of what happened in the Great Depression, the Savings and Loan crisis, and the 2008 Financial Crisis: the government always stepped in to repair the money system. And as guarantor of the social relation, it always will.

Monetary theorists understand the government’s monetary prerogative in three ways. First is the government’s ability to choose the unit of account that is used in the country—dollars in the United States and Canada. Second is the government’s ability to issue those units of account into circulation. Third is the benefit of first use that comes with issuing money. This last right is called seigniorage and can be thought of as the profit of creating money above the cost of printing and distributing that money.

Money has existed as a state-managed tally of owing and being owed (of credits and debts in theoretical parlance) for thousands of years. In fact, a lot of evidence suggests that such monetary systems existed for thousands of years before coins and markets—and might even be the reason humans began to settle in the first place! (See Money: The Unauthorized Biography.) Capitalism is a relatively new manner of social organization and is characterized by a transition from state-created money to bank-created money.

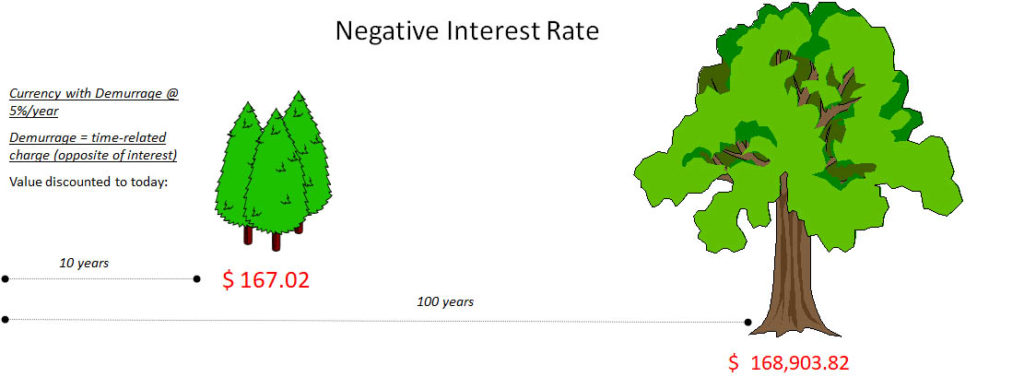

Think about that for a moment. Capitalism is about bank-created money! For thousands of years, the state, for better or worse, controlled three monetary prerogatives discussed above. The state created money by spending it into existence and guaranteed its value by levying taxes in the unit of account in which it spent. Beginning around the twelfth century, however, states began to expand beyond what their power to tax could justify and so they asked private merchants for loans. (See Brown 2013, p.111, and Davies 2002, p.261.) Slowly but surely, states lost the majority of their power to create money and the seigniorage benefit that came with that creation. States only kept the power to determine the unit of account. But with that power came the responsibility to manage the stability of the unit of account.

There has been precious little discussion on ending or reigning in the commercial banking industry’s money-creation power.

It is this strange conflict of interest with which this paper is most concerned. The state is forced to ensure a stable dollar, but it isn’t able to determine how—or for what—dollars enter society. So while much of the discussion surrounding the Green New Deal concerns ending or reigning in capitalism, there has been precious little discussion on ending or reigning in the commercial banking industry’s money-creation power.

While capitalism is often thought of as the private accumulation of surplus, the manner in which that accumulation is enabled is often ignored. Commercially created money means that production surpluses remain within the private sector. Were the state to take back the power to create money, and the seigniorage benefit that comes with such creation, it would severely limit the extent to which the private sector could accumulate surplus. In fact, nationalizing money creation would align the right of the state to create money with the responsibility it bears to manage money’s stability.

Perhaps most importantly, by regaining the monetary prerogative, the state could influence the direction of the economy by spending and lending money into existence in accordance with its goals. In the case of the Green New Deal, these goals would be social justice and environmental sustainability. This would mean that the tenets of the Green New Deal—from healthcare and education to healthy food and sustainable energy—would become structural components of a just and sustainable economy and not simply regulatory mechanisms of an extractive capitalism.

The Green New Deal, as currently written, is an end-of-pipe regulatory framework that relies upon taxing bank-created money to finance social and environmental spending.

This is a huge difference! By avoiding a discussion of a nationalized money supply, the Green New Deal, as currently written, is an end-of-pipe regulatory framework that relies upon taxing bank-created money to finance social and environmental spending. A nationalized money supply would transform government spending into the monetary creation mechanism and embed justice and sustainability as hallmarks of how we manage our national economy.

Joe Ament, PhD, is an ecological economist at The University of Vermont whose research explores monetary theory and policy in the context of socio-ecological equity.